We are accepting new cases

Asset Tracing

Specialized asset tracing services to identify, verify, and document financial and physical assets across multiple jurisdictions using advanced investigative methods and proprietary intelligence tools.

🕵️♂️

How does the investigation process work?

01

Introductory Consultation

The client contacts us via form, email, or phone. We discuss the basic context of the case, clarify the investigative goals, and assess whether the service is suitable.

02

Case Evaluation and Plan Proposal

Based on the information provided, we design an investigative strategy, estimate costs, and propose a timeline. The client approves the plan and signs a service agreement.

03

Advance Payment

Before initiating the investigation, an advance payment is required based on the agreed scope and estimated workload. Work is carried out up to the value of the paid advance.

04

Investigation Launch

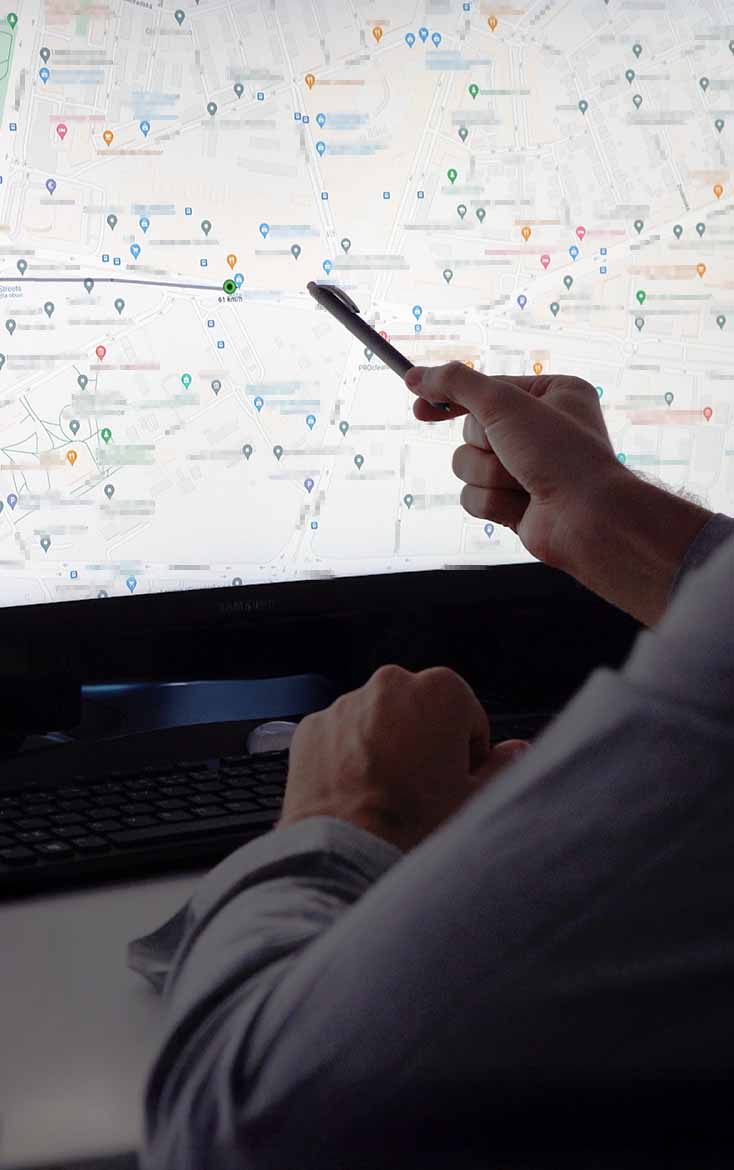

We initiate the investigation, which may include physical surveillance, data gathering, digital tracking, or a combination of methods. Ongoing updates are provided as agreed.

05

Documentation and Analysis

All gathered materials are carefully documented, organized, and analyzed.

06

Final Case Report

Upon completion, the client receives a detailed case report including photographic or video evidence, observations, and findings — structured clearly and professionally.

Asset Tracing in Corporate and Legal Investigations

Asset tracing is a highly technical investigative process aimed at locating, identifying, and verifying ownership of financial and tangible assets held by individuals or corporate entities. This service is essential in cases involving fraud, litigation, debt recovery, divorce proceedings, and corporate disputes, where transparency of asset portfolios directly influences legal and financial outcomes.

Access to Restricted and International Databases

Our investigators leverage access to non-public financial registries, property records, vehicle ownership logs, corporate filings, and regulated banking information (where legally permissible). Combining these with intelligence from cross-border financial networks allows us to trace assets across multiple jurisdictions, including those concealed through complex corporate structures or offshore entities.

Identification of Hidden Assets and Complex Ownership Structures

High-value individuals and corporations often employ sophisticated methods to obscure real ownership, such as shell companies, trusts, layered transactions, and nominee arrangements. Our team uses forensic accounting techniques and corporate intelligence tools to map these structures, revealing ultimate beneficial owners (UBOs) and associated entities.

Financial and Digital Forensics

Asset tracing frequently requires a digital-first approach, especially when investigating cryptocurrency holdings, digital wallets, or blockchain-based transactions. Through blockchain analytics, metadata examination, and financial pattern analysis, we uncover hidden wealth streams that traditional investigations may overlook.

On-the-Ground Verification and Physical Asset Checks

Beyond financial records, our operatives conduct field verifications to confirm the existence and location of physical assets, such as real estate properties, luxury vehicles, artwork, or corporate inventories. This ensures that every asset documented in our reports is both real and legally linked to the subject.

Legal Compliance and Evidentiary Standards

Every step in the asset tracing process adheres to data protection laws, anti-money laundering (AML) regulations, and jurisdiction-specific privacy requirements. Our reports are structured to meet evidentiary standards, making them admissible in court or arbitration proceedings.

Do you have a Questions?

By submitting this form, you agree to the processing of your personal data in accordance with our Privacy Policy.

Need Answers? Start Here

🔥